Seagate Capital Real Estate Partners Fund I

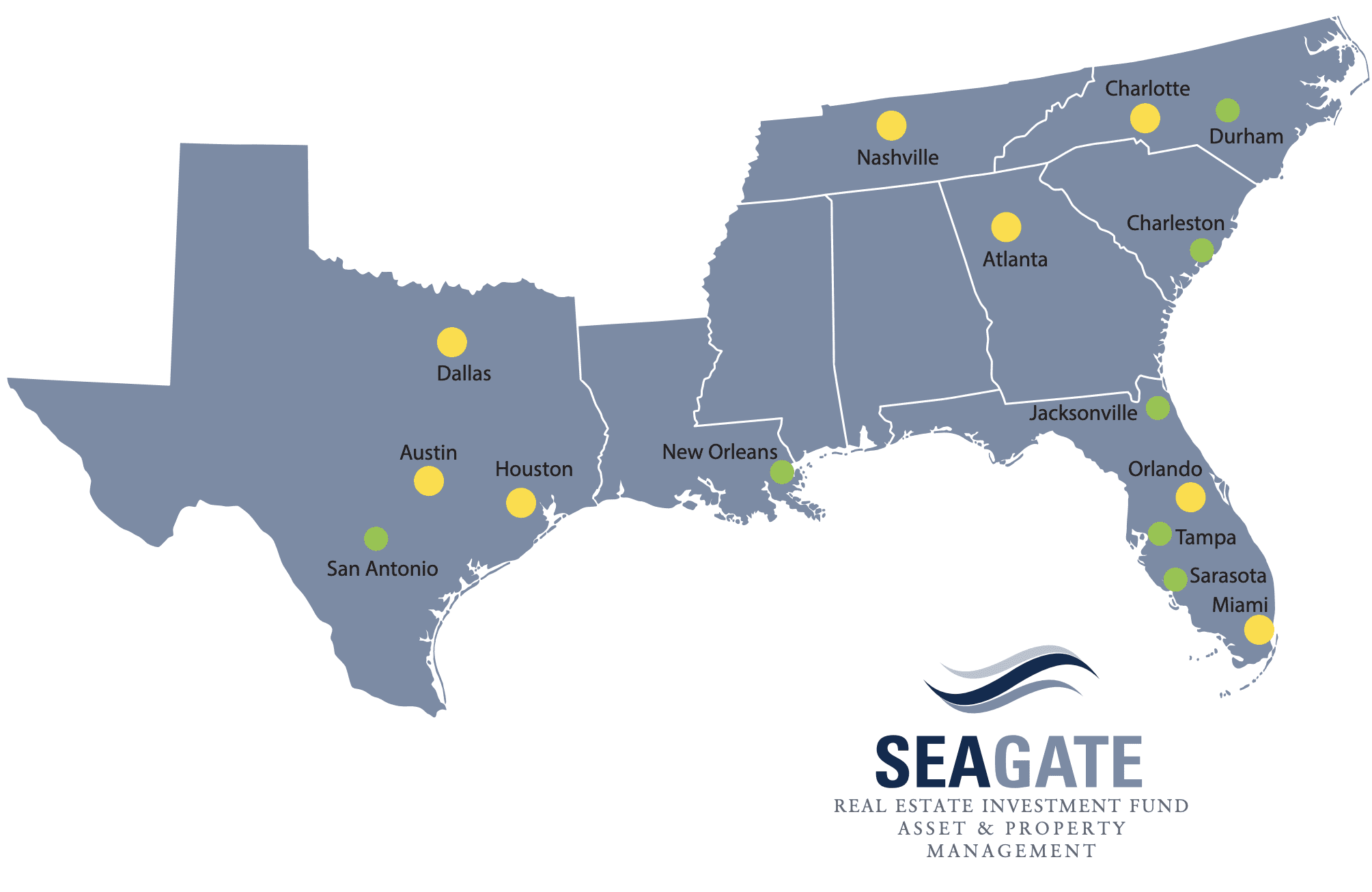

Seagate Capital Real Estate Partners Fund I is the flagship value-add investment vehicle sponsored by Seagate. Currently in the fundraising stage, the fund sponsors are accepting applications for investor participation. Designed to invest over a 3-year period, with a fund-life of 9 years, Fund I has a geographic focus on the core / core+ markets throughout the Sunbelt.

Overview

Seagate Capital Real Estate Partners Fund I is the flagship value-add investment vehicle sponsored by Seagate. Currently in the fundraising stage, the fund sponsors are accepting applications for investor participation. Designed to invest over a 3-year period, with a fund-life of 9 years, Fund I has a geographic focus on the core / core+ markets throughout the Sunbelt.

Pricing Advantages

Under-Performing Assets

Compelling Event-Driven Strategies

- Off-market transactions

- Mispriced or out-of-favor credit

- Structured finance applications

- Rapid funding requirements

- Temporary market dislocations

- Illiquid conditions

- Corporate dispositions

Under-Performing Assets

- Vacancy issues

- Below market rents

- Bloated operating expenses

- Capital deficiencies

- Reputational issues

- Poor management

Compelling Event-Driven Strategies

- New development

- Renovation, redevelopment

- Conversion, adaptive reuse

- Consolidation synergies

- Environmental remediation

- Workout scenarios including bankruptcy, foreclosure or recapitalization